Whether you’re an avid reader of finance news, or you just fancy a quick browse, take a look below as we bring you the latest industry updates.

Want to know what's happening in the world of home loans and finance? Here we talk about everything from changing economy rates, inflation, and interest, to government incentive schemes.

What's new in the world?

How the 2025–26 federal budget affects Australian mortgage holders

Australia’s 2025–26 federal budget arrives at a time when many people – from first-home buyers to seasoned property investors – are feeling the pinch of rising living costs and fluctuating interest rates.

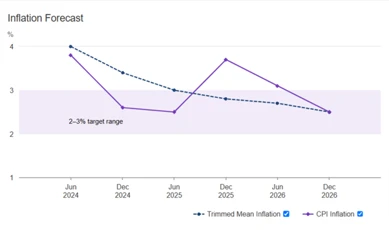

What’s in store for interest rates in 2025?

With the cash rate remaining steady at 4.35% for 12 consecutive months, the question on many homeowners' minds is: when will it start to fall?

Practical tips for saving a mortgage deposit

If you're looking to boost your home loan deposit, there are various methods you can put to use to maximise your savings. We've put together our top tips below to help you get mortgage ready.

What are non-genuine savings?

The term ‘non-genuine savings’ is commonly used in the context of home loan applications. It refers to funds that are not considered to be authentic savings by lenders.

Stay on track with your loan

A home loan isn’t something to lock away and forget. Just like a regular health check keeps you feeling your best, a quick review of your loan can keep your finances in shape.

Investing in property with confidence: What you need to know

🏘️ Investing in property is a popular strategy for Australians looking to build long-term wealth. Whether you're considering your first investment or expanding an existing portfolio, understanding how investment property lending works and what to expect is key to making informed decisions.

No posts currently available

Prefer to keep reading?

Check out our library of expert advice articles for handy tips and tricks for navigating the world of mortgages.